Columbia ISA

home

– ›

Search

Google

SEARCH Columbia ISA Site

Silver

Your Guide to Buying

About Silver Coins

Gold

Coins

• Gold

Eagle

• Gold

Maple Leaf

• Krugerrand

• How

to test for fake silver coins

Silver

Coins and bars

Silver is one of the basic elements with the chemical symbol Ag from

the Latin argentum. Silver is a precious metal used in jewelry, coins

and many industrial uses. Many nations have used silver as their basic

unit of monetary value. Silver can be alloyed with copper, zinc and

other metals. The U.S. used silver in general circulating coins until

1964 and produced the last circulating silver coin in 1969.

The U.S. Mint issues

a one troy oz. .999 fine silver coin, the silver eagle, with a one

dollar face value. The Royal Canadian Mint issues a one troy oz. .9999

fine silver coin, the silver maple leaf, with a five dollar face value.

Australia, Austria, China, Mexico and Great Britian also mint bullion

silver coins.

Silver has been used as money for centuries. In many languages around

the world, silver and money are the

same word.

Recorded use of silver to prevent infection dates to ancient Greece and

Rome; it was rediscovered in the Middle Ages, when it was used for

several purposes, such as to disinfect water and food during storage,

and also for the treatment of burns and wounds as wound dressing. In

the 19th century, sailors on long ocean voyages would put silver coins

in barrels of water and wine to keep the liquid potable.

The Silver

Market

Precious metals are traded all over the world, from New York and London

to Hong Kong and Shanghai. The silver market is like most, subject to

supply and demand. The supply is limited and requires expensive mining

and refining or recycle of existing silver. The demand comes from

industry, jewelry and investment. The price of silver changes as market

conditions change. This includes many factors including world economic

activity. The price in the USA is expressed in US dollars per

troy ounce.

For

the average silver trader, the spot price is used to value an ounce of

silver. The spot price is the price of silver for immediate delivery

and changes throughout the trading day until the market closes. The

spot price is also influenced by the futures price, that is the price

of silver for delivery months in the future. The current spot price can

be seen at sites like

www.kitco.com

http://www.kitco.com/charts/livesilver.html#ny

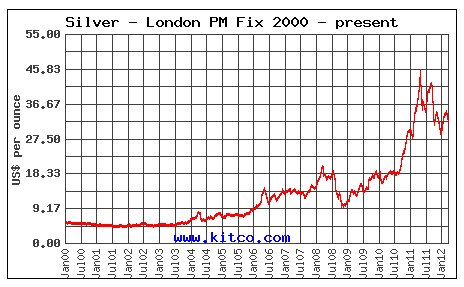

From 1990 to 2003, the price of

silver was between $4 to $6 per ounce.

The average silver price in 2003 was $4.85 per ounce. In 2006, the

silver price experienced a 58% increase over the average 2005 price of

$7.31 per ounce. The silver price reached levels not seen in 26 years.

The primary factor driving the stronger silver price was the continued

strength of investment demand. Much of the investment demand can be

attributed to the launch of Barclays’ Global

Investors iShares "Silver Trust" Exchange Traded Fund (ETF), (SLV

sitcker symbol) which was introduced in late April 2006. Silver posted

an average price of $14.67 in 2009. Silver posted an average price of

$20.19 in 2010. In 2011, silver rose to over $45 per ounce before

correcting to around $30 per ounce at years end.

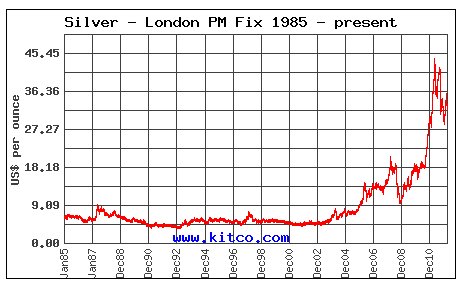

Silver Prices - 1985 to 2012

London Fix

is the price per ounce of

silver set by three market making members of the London Bullion Market

Association at approximately 12:00 noon, London time, on each working

day.

Silver Prices - 2000 to 2012

Buying

Silver Bullion Coins or Bars

When you buy silver bullion coins or bars, you pay the current spot

price plus an extra premium which is the dealers charge for the

transaction. The premium varies dealer to dealer and also from coin to

coin. Bars usually sell for less premium than coins. Part of the

premium is the dealers profit. Silver bullion has no collector value,

so you do not pay extra collector market value for coins. If you are

going to buy a large amount of silver, the premium becomes a concern. A

dealer who charges more than $4 over spot is ripping you off. A good

dealer will usually charge $2.50 to $3.50 over the current spot price

for a one oz. bullion coin such as the silver eagle.

Where you buy silver bullion is very important. You want to buy from a

known dealer so you don't buy a fake coin or bar. All kinds of tricks

are used to fake the metal content. There are hundreds of reliable well

known coin dealers so don't buy from an unknown source. Do some

research online. Check out the dealer before buying. Ask about the

methods to verify the silver coin such as weighing the coin to make

sure it is real.

Rare

Silver Coins

Coins

with a

collector value are referred to as numismatic coins because they are

rare or desirable beyond their silver content. These silver coins are

graded on a scale which identifies the coins quality. The grades have

evolved over time from used and new to grades of good, fine, very fine

up to BU (brilliant uncirculated). The MS description refers to "mint

state" for uncirculated coins and are graded from MS60 to MS70 with

MS70 being a perfect coin.

Professional Coin Grading Service (PCGS) is a third party

authentication and grading service for rare coins.

PCGS was originally started by seven coin dealers in 1985 to

standardize coin grading. PCGS and its competitors play a key role in

rare coin markets as a supplementary quality analysis provider for

collectors in assessing the quality of particular coins. Even small

differences in coin quality can result in dramatic differences in

market pricing. In March 2010 PCGS announced its Secure Plus service,

which digitally takes a unique "fingerprint" of each coin and enters it

into a permanent database.

SILVER

COINS of The United States of America

The Coinage Act of 1792 established the framework for the coins used in

the USA. The U.S. coins for circulation with silver content include

dollar, half-dollar, quarter and dime coins, however, since 1965 with

few exceptions, silver is no longer included in coins in circulation.

Coins today for circulation are copper with nickel exteriors. Only the

silver eagle bullion coin and some proof sets are being minted with

silver content.

MORGAN

SILVER DOLLAR

The Morgan Dollar is one of the most collected silver coins in U.S.

history. First produced in 1878. Both the Morgan and the Peace silver

dollars have an eagle on the reverse side but the Morgan's eagle has

spread wings while the Peace's eagle has folded wings.

Morgan Silver Dollar Coin Minting Information

The largest and heaviest silver coin since the Civil War, the Morgan

silver dollar contains 0.77344 ounces of pure silver. It was minted

continuously from 1878 to 1904 when the government exhausted its supply

of silver bullion. Congress would pass the Pittman Act in 1918,

recalling over 270 million silver dollars for melting and the Morgan

dollar would be minted one last year in 1921 before being replaced by

the Peace Silver Dollar.

Morgan Silver Dollar Coin

Coin Designer: George T. Morgan

| GROSS

WEIGHT |

SILVER

CONTENT |

COMPOSITION |

DIAMETER |

COIN

EDGE |

| 26.73g |

0.77344

oz. |

90%

silver, 10% copper |

38.1mm |

Reeded |

Dates: 1878-1904; 1921

US Mint Branches: Carson City (1878-1893), Denver (1921 only), New

Orleans (1878-1904), Philadelphia (all dates), San Francisco (all

dates)

MORGAN SILVER DOLLAR

PEACE

SILVER DOLLAR

The Peace Dollar was minted to commemorate the signing of the peace

treaty between the United States and Germany at the end of World War I.

All Peace Silver Dollars were struck in high relief in 1921, their

first year of production. The design was slightly modified in 1922 and

normal relief coins were struck later that year. Peace Dollars were

struck continuously until the effects of the Great Depression were felt

in 1929. The U.S. Mint began producing the Peace Dollar again in 1934,

but coins dated 1935 would be the last to see circulation.

Peace Silver Dollar Coin

| GROSS

WEIGHT |

SILVER

CONTENT |

COMPOSITION |

DIAMETER |

COIN

EDGE |

| 26.73g |

0.77344

oz. |

90%

silver, 10% copper |

38.1mm |

Reeded |

Dates: 1921-28, 1934-35

U.S. Mint Branches: Denver (1922-23; 1926-27; 1934), Philadelphia (all

dates), and San Francisco (1922-28; 1934-35)

Coin Designer: Anthony De Francisci

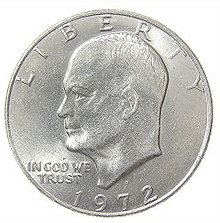

Eisenhower

Dollar

The Eisenhower Dollar followed the Peace Dollar and is named for

General of the Army and President Dwight David Eisenhower, who appears

on the obverse. Both the obverse and the reverse of the coin were

designed by Frank Gasparro. The Eisenhower Dollar is a $1 coin issued

by the United States government from 1971–1978. The

Eisenhower dollar was the last dollar coin to contain a proportional

amount of base metal to lower denominations; it has the same amount of

copper-nickel as two Kennedy half dollars, four Washington Quarters, or

ten Roosevelt dimes. Because of this it was a heavy and somewhat

inconvenient coin. It was often saved as a memento of Eisenhower and

never saw much circulation. This led to its short time in circulation

and its replacement by the smaller, but even less popular, Susan B.

Anthony dollar in 1979.

The Eisenhower Dollar was struck with a copper-nickel composition for

circulation and was the first United States dollar coin to not be

struck in a precious metal, although special collectors' issues were

struck at the San Francisco Mint in a silver-copper composition the

same as the 1965-70 Kennedy half dollar.

Copper-nickel issues:

Weight: 22.68 grams

Composition: Outer Layers of 75% copper, 25% nickel with a center layer

of 100% copper

Silver-copper issues (silver clad):

Weight: 24.59 grams

Composition: Outer layers of 80% silver with a center of 20.9% silver.

Aggregate 60% copper, 40% silver

Silver content: 0.3164 troy ounce (9.841 grams)

Some Eisenhower Dollars were minted in a 40% silver clad to be sold to

collectors. All of these coins were minted at the San Francisco Mint,

with dates 1971, 1972, 1973, 1974, and 1776-1976. Coins minted in 1975

and 1976, all dated 1776-1976 for the Bicentennial, come in packaging

with the similarly dated quarter and half dollar of that brief series.

Walking

Liberty Half Dollar

The Walking Liberty Half Dollar is a silver half dollar coin issued by

the United States government, equal to fifty cents. Walking Liberties

were minted from 1916 to 1947. The Walking Liberty half dollar obverse

(front) is considered one of the best designed silver coins in American

coinage. As a result, the obverse design was used for the American

Silver Eagle bullion coin.

Specifications:

Value 0.50 U.S. dollars

Mass 12.50 g

Diameter 30.6 mm

Thickness 1.8 mm

Edge reeded

Composition 90 % Ag

10 % Cu

Years of minting 1916–1921; 1923; 1927–1929;

1933–1947

Each Walking Liberty, as did the Franklin and the Kennedy half-dollar,

contained 0.36169 oz pure silver when minted. A junk silver bag ($1,000

face) of circulated half-dollars weights right at 55 pounds. Because

half-dollars suffered less wear than dimes and quarters, a junk silver

bag ($1,000 face) of half-dollars will net 718-720 ounces of silver if

smelted, whereas a bag of dimes or quarters will net about 715 ounces.

This is one reason half-dollars carry higher premiums than dimes

and

quarters.

Franklin

Half Dollar

Reverse of Franklin Half Dollar

The Franklin half dollar is a coin struck by the United States Mint

from 1948 to 1963. The fifty-cent piece pictures Founding Father

Benjamin Franklin on the obverse and the Liberty Bell on the reverse. A

small eagle was placed to the right of the bell to fulfill the legal

requirement that half dollars depict the figure of an eagle. Produced

in 90 percent silver with a reeded edge, the coin was struck at the

Philadelphia, Denver, and San Francisco mints. Beginning in 1964 it was

replaced by the Kennedy half dollar.

Specifications:

Value 50 cents (0.50 United States dollars)

Mass 12.50 g (0.40 troy oz)

Diameter 30.61 mm (1.21 in)

Edge reeded

Composition 90% Ag

10% Cu

Years of minting 1948–1963

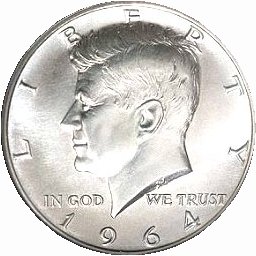

Kennedy

Half Dollar

Starting with 1965-dated pieces, the percentage of fine silver was

reduced from 90% to 40%. In 1971, silver was eliminated entirely from

the coins. Since 2002, Kennedy half dollars have only been struck to

satisfy the demand from collectors, and are available through the Mint.

Value 50 cents (.50 United States dollar)

Mass 11.34 g

Diameter 30.6 mm

Thickness 2.15 mm

Edge reeded

Composition Core: 100% cu

Cladding: 75% cu, 25% ni

Years of minting 1964–present

Washington

Quarter Dollar

The U.S. quarter dollar is one of the most popular and most used coins

in circulation.

The Washington quarter has been in circulation from

1932 until the present day.

Quarter Dollars

Draped Bust (1796-1807)

Capped Bust (1815-1837)

Seated Liberty (1838-1891)

Barber (1892-1916)

Standing Liberty (1916-1930)

Washington Head (1932-Date)

In 1932 the Washington Quarter made its debut, replacing the former

Standing Liberty Quarter design. A change in metal composition from 90%

silver to 75% copper clad in 25% nickel starting in 1965. Not until

1992-S, in special proof sets, did the 90% silver Washington Quarter

reappear. In 1999 the State quarter reverse design began. Five states

per year were released. But this did not end in 2008 when the last

states were issued. American territories and in 2010, the U.S. national

parks continue the trend.

Non-clad silver quarters weigh 6.25 grams and are composed of 90%

silver, 10% copper, with a total silver weight of .18084 oz pure

silver. They were issued from 1932 through 1964.

1932-1964 and 1992-S to Present (Select Proof Sets Only)

Designer: John Flanagan

Diameter: 24.3 millimeters

Metal Content:

Silver - 90%

Copper - 10%

Weight: 96.6 grains (6.3 grams)

Edge: Reeded

Mint mark: None (for Philadelphia, Pennsylvania) below the wreath on

the reverse

COPPER-NICKEL/COPPER CLAD PLANCHETS (1965-DATE)

Designer: John Flanagan

Diameter: 24.3 millimeters

Metal content:

Outer layers - 75% Copper, 25% Nickel

Center - 100% Copper

Weight: 88 grains (5.7 grams)

Edge: Reeded

Mint mark: None (for Philadelphia, PA) below the wreath on the reverse

1976-S QUARTER DOLLAR - BICENTENNIAL ISSUE -

40% SILVER

Designer: Obverse by John Flanagan; Reverse by Jack L. Ahr

Diameter: 24.3 millimeters

Metal content:

Outer layers - 80% Silver, 20% Copper

Center - 20.9% Silver, 79.1% Copper

Weight: 90 grains (5.7 grams)

Edge: Reeded

Mint mark: "S" (for San Francisco, CA) on the obverse just right of the

ribbon

Roosevelt

Dime

The dime is a coin 10 cents, one tenth of a United States dollar. The

dime is the smallest in diameter and is the thinnest of all U.S. coins

currently minted for circulation. The term dime comes from old French

"disme" meaning "tithe" or "tenth part", from the Latin decima. From

1796 to 1837, dimes were composed of 89.24 percent silver and 10.76

percent copper. With the passage of the Coinage Act of 1965, the dime's

silver content was removed. Dimes from 1965 to the present are composed

of outer layers of 75 percent copper and 25 percent nickel, bonded to a

pure copper core.

Draped Bust 1796–1807

Capped Bust 1809–1837

Seated Liberty 1837–1891

Barber 1892–1916

Winged Liberty Head (Mercury) 1916–1945

Roosevelt 1946–present

Starting in 1992, the U.S. Mint reintroduced silver coins in its annual

collectors sets. This included a 90 percent silver proof Roosevelt

Dime, Washington Quarter(s) and Kennedy Half Dollar, a series that

continues today.

Junk

Silver

Until 1965, U.S. coins, dimes, quarters, half-dollars, were made of 90%

silver. 1964 was the last year that coins were made of 90% silver and

10% copper. These pre-1965 coins are often referred to as "Junk

Silver". You can buy these coins in a "bag" which contains a specified

amount of face value silver coins and can be a mixture of dimes,

quarters and half dollars all containing 90% silver. A "bag" in the

common usage refers to $1000 face value in silver coins. These bags do

NOT sell for $1000 but for the value of the silver.

How

to calculate the

value of Junk Silver

A typical $1000 face value bag contains about 715 ounces of silver. If

you know the current price of silver, you can multiply it by 715 to get

the silver value of a $1000 bag. (The silver market goes up and down

over time hitting highs and lows. In 2011 silver prices have been going

up and up. In July 2011 for example, spot silver was rising above $40

per oz.)

For this example we will use $28 per oz.

715 * $28 = $20,020 for example.

This is for $1000, so $1 in silver coins is worth 1/1000 of this amount

which is $20.

Dimes come in rolls of 50 with a $5 face value, each $5 roll would be

worth $100.

Quarters come in rolls of 40 with a $10 face value, each $10 roll would

be worth $200.

You can purchase rolls or bags of silver coins and if you check the

current silver price and use these calculations you can determine what

the value is.

Another example: $1000 face value bag of all quarters = 4,000 quarters

at 0.18084 oz. of silver = 723 oz. at $28 per oz. = $20,254.

Half bag $500 face 358 oz., quarter bag $250 face 179 oz., and tenth

bag $100 face 72 oz. are also available and you can buy coin by coin.

If you want 133 quarters for example, a dealer can count out any value

you want.

• Silver

content of U.S. coins

Silver

Bullion - Coins and Bars

Bullion has no collector value. You just pay for the silver content.

Silver bullion coins, bars and rounds are available. The U.S. Mint

produces each year the American Silver Eagle bullion coin, a 1 troy oz.

coin of .999 fine silver with a face value of one dollar.

The Silver Eagle dollar was first released by the U.S. Mint on November

24, 1986. It contains one troy ounce of .999 Pure Silver, and has a

nominal Face Value of One Dollar. Its weight and content is certified

by the U.S. Mint. For coin collectors, the U.S. Mint produces a proof

version of the coin. The Silver Eagle dollar has been produced at three

minting locations, including Philadelphia (‘P’

mintmark), San Francisco (‘S’ mintmark) which

issued proofs, and more recent proofs from West Point.

An authentic Silver Eagle dollar will weigh at least 31.103 grams, and

its diameter is 40.60 mm, with a thickness of 2.98 mm. Its edge must be

reeded, and the Silver content is 99.9%. The obverse design features

walking Liberty and is adapted from the design of Adolph A. Weinman

during the year 1916. The reverse design features a Heraldic Eagle with

Shield, 13 stars, and United States of America on top, which was

designed by John Mercanti in 1986.

The U.S. Mint sells Silver Eagles in "tubes" 20 coins per tube and

"monster" boxes of 25 tubes (500 coins). One tube (20 coins) of silver

eagles should weigh roughly 670 grams give or take a few grams

depending on the tube's weight and the slight variations in the coins

weight.

Silver Eagle tube of 20 coins from the U.S. Mint

Silver Eagle Monster Box of 25 tubes at 20 coins each totals 500 coins

(500 oz.)

Mintages of Silver Eagles has been from about 4 million to 10 million

per year from 1986 until 2007, with 1996 being the lowest at 3.6

million, but starting in 2008, mintages have increased dramatically to

20 million, then 29 million in 2009 and almost 35 million in 2010. In

2011 39,868,500

silver eagles, just under 40

million, were sold according to the U.S. Mint.

CANADA Silver Bullion

The Royal Canadian Mint issues a silver bullion coin, the silver maple

leaf. In 1988, the Mint introduced a Silver Maple Leaf Series that would hold a $5 CAD legal tender and

contain one troy ounce of .9999 silver. The coin comes in tubes of 25 coins. The

Monster box of silver maple leafs is like the USA version only with 20

tubes in yellow instead of green. So you still get 500 coins (500 oz.)

Three different profiles of Queen Elizabeth II have appeared on the series over the course of its issuance. The Sugar Maple Leaf

design has not been significantly changed since its debut, however, the Mint has added security features over the years

that alter the coins appearance, while ensuring its authenticity.

Canadian Monster Box of silver maple leafs

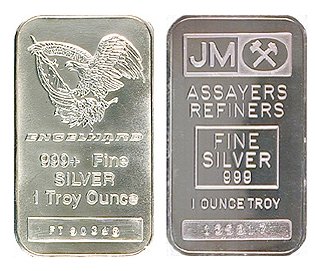

Silver

Bars

Bars are an alternative to coins. Bars are typically available in 1

oz., 10 oz., and 100 oz. .999 fine silver. Bars of silver are produced

by refiners and bear the name of the refiner. Reputable refiners

include Engelhard, Johnson Matthey, Pan American Silver Corp.,

Westminster Mint, Sunshine Mint, Northwest Territorial Mint, and

A-Mark. The public demand for physical silver product started in the

early 1970s. By the mid to late-1970s, Johnson Matthey and Engelhard

dominated the market.

Engelhard and Johnson Matthey silver bars

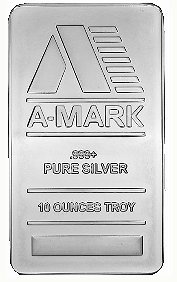

Sunshine Mint ten oz. silver bar and A-Mark ten oz. silver bar

The premium over spot silver is slightly lower for 1-oz silver bars

than for 1-oz silver coins (Canadian Maple leaf silver coins or

American Silver Eagle coins) or for 1-oz silver rounds like Engelhard

Prospectors. You can buy 1-oz silver bars on Ebay, Amazon or from

online precious metals dealers. Also COMEX, APMEX and MONEX.

Silver bullion bars are a popular way to buy silver. Engelhard silver

bullion products are the best-known brand in the industry. Engelhard

was one of the world’s largest refiners of precious metals

before being purchased by BASF in 1986. Since these bars have not been

issued since the 1980’s the only way to buy them is in the

secondary market. Each bar is hallmarked stamped for weight and purity.

Silver

Rounds

Silver rounds contain one ounce of .999 fine (99.9% pure) silver. Among

the most popular and well-known 1-oz silver rounds presently being

minted are those carrying the names of Sunshine Minting and A-Mark

Precious Metals. Other 1oz silver rounds, but without the mints' names,

are the Buffalo/Indian Head silver rounds and the Standing Liberty

silver rounds.

Sunshine silver rounds are popular because they are usually readily

available, and the name Sunshine is nearly synomomous with silver

because of the famed Sunshine silver mine in Coeur d'Alene, Idaho.

Sunshine silver rounds are sometimes called silver eagle rounds because

the front depicts an eagle flying through the sun. However, in the

silver bullion community, the term Silver Eagles is reserved for the

U.S. Mint's American Eagle silver coins.

A-mark silver rounds have been manufactured since 1983 and sometimes

show up in the secondary market. However, most A-mark silver rounds now

available are new, 20 coins to a tube. A-mark silver rounds carry an

image of the Liberty Bell on one side and an image of an eagle on the

other. They are clearly marked 1-oz .999 silver.

Buffalo silver rounds

Buffalo/Indian Head silver rounds are relatively new but are widely

accepted because of their design: the legendary U.S. Buffalo/Indian

Head nickel, which was minted 1913-1937. Across the top on the back is

UNITED STATES OF AMERICA. However, the coins are privately-minted.

Standing Liberty silver rounds

The classic Augustus Saint-Gaudens' Standing Liberty, which graces the

beautiful $20 Double Eagle gold coins (1908-1933) known as the

Saint-Gaudens, stands proudly on the Standing Liberty silver rounds.

The reverse carries an image of a magnificent gold eagle.

Generic silver rounds

Generic silver rounds refers to 1-oz .999 silver rounds that generally

are not identified by their names. With the silver bullion industry now

in its fourth decade, many silver rounds fall into the category of

generic silver rounds.

Engelhard Prospector silver rounds

From 1975 to 1988, Engelhard produced 1-oz Prospector silver rounds.

The Prospector silver rounds were so named because the obverse of the

round bears the image of a prospector panning for gold. Because of

their high quality and the name Engelhard, Prospector silver rounds

have remained extremely popular with silver investors. Engelhard

Prospectors are no longer made and are available only when investors

sell into the secondary market, which is not often. When Prospector

silver rounds are available at only slightly higher prices than other

silver rounds, buy them.

The Engelhard Prospector Silver Round

Johnson Matthey silver rounds

In the mid-1980s, Johnson Matthey, a company in the precious metals

industry as respected as Engelhard, minted Freedom Rounds, so named

because they celebrated the first ten amendments to the U.S.

Constitution, known to all Americans as the Bill of Rights. Freedom

silver rounds are excellent pieces and should be acquired when

available; however, few were made, and they rarely show up in the

secondary market. Johnson Matthey Freedom silver rounds and Engelhard

Prospector silver rounds carry about the same premiums.

When originally manufactured, Johnson Matthey Freedom silver rounds

came in Mylar sheets of twenty. When they show up in the secondary

market, sometimes they are still in the original Mylar packaging.

Question:

What percent of my net worth should I invest in precious metals?

Answer:

That depends on several factors. Every person is different and is in a

different situation. If you are young, you have a different perspective

than an older person. Your goals could be very different from someone

else's goals. Regardless, nobody knows for sure what is going to happen

to the world economy in the future. Diversification is the key. By

having a stake in many areas you should not lose out big if one area

falls. Have some stocks, have some real assets, have some cash, have

barter items and have some precious metals. With this thinking,

generally speaking about 15% in precious metals is a good guideline.

Patience is a large part of your strategy. Little moves over time is

better than rash plunges all at once. Remember information is power.

The more you know about an area the better decisions you can make.

• Silver

Coins International

• Gold

Coins and jewelry

• Gold

Eagle

• Gold

Maple Leaf

• Krugerrand

• Diamonds

Buying Guide

• Diamond

Rings

• How

to tell if a Diamond is real

• What

is moissanite?

• How

to read a diamond certificate

Bullion

Dealers and Coin Links

Provident Metals

• Provident

Metals

Gold, Silver, Platinum, Copper, Palladium, U.S. and foreign coins

Order by phone 877-429-8790

Provident

PO Box 325

Lavon, TX 75166

sales@providentmetals.com

• Omega

Precious Metals, Inc.

18 Village Square Glen Cove, New York 11542

1-800-474-6960 or 516-759-6960 Fax: 516-759-6979

Email: JoeHylas@AllCoins.US

• OnlyGold

CSG Inc. 4216 West Dunlap Avenue, Phoenix AZ 85051-3654

1-800-800-4485

• Certified

Coin Exchange

• Wexford Coin

Wexford Capital Management

David W. Young, President

113 Brenton Court

Stephens City, Virginia 22655-4819

(877) 855-9760

Fax (866) 611-3526

• Tulving

• Gold coins

bullion

• Encore gold

Encore Gold, LLC

307 Division Street

Northfield, MN 55057

(877) 563-8736

• Fort

Worth Coin

• Gold central

• Goldline

• Coin maven

• Coins

plus

• Gold

coins

• MJPM

• USA

Gold

• AJPM

• Amerigold

• APMEX

• Austin Coins

• Blanchard

• Coin

guy

• Gold dealer

• Camco coin

• Certified

gold exchange

• Certified Mint

• Goldmasters USA

• Coin guide

• Precious metals

• Jack

Hunt Kenmore N.Y. 14217

(800)877-7424

• JT Coins

• Louisiana gold

• Merit Financial

• The

US Mint - Current Mint Issues

• US Bureau of

Engraving - Currency for the Collector

PCGS - Professional Coin Grading Service

NGC - Numismatic Guarantee Corporation

ANACS - American Numismatic Authentification Certification Service

I.C.T.A. - Industry Council for Tangible Assets

• World

Gold Council

|

|

|